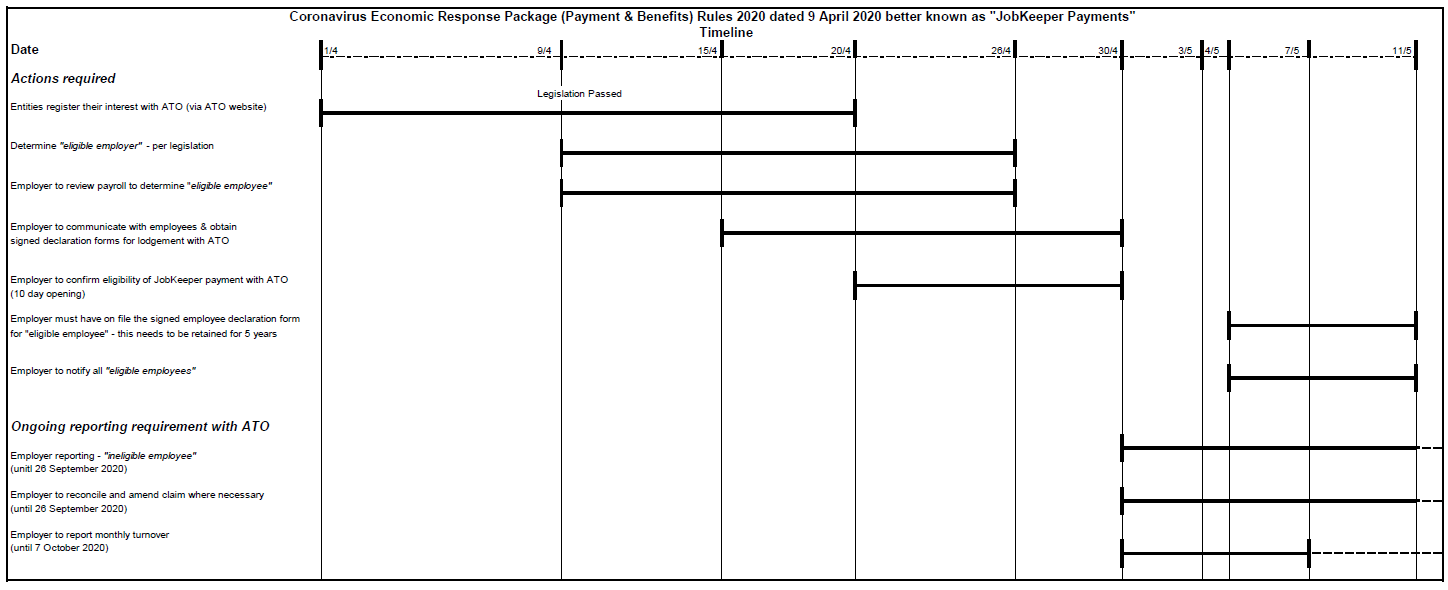

JobKeeper Timeline

(Click on image to view full size)

myGov ID

myGov ID is required to access the business portal which facilitates the JobKeeper payment (https://bp.ato.gov.au/). The following needs to be lodged via myGov ID:

- Registration with the Australian Taxation Office (ATO) as an Eligible Employer, for the fortnights commencing 30 March & 13 April registration must be lodged by 30 April 2020.

- Lodgement of the business monthly statement by 7 calendar days following month end detailing:

- Reconfirm eligible employees

- Notify any ineligible employees

- Monthly current and projected GST turnover

Logging in to the business portal requires a myGovID (myGovID has replaced Auskey).

If you do not have a myGovID, set up or linked to your business please refer below:

Setting up online services using myGov ID and RAM

Refer to the ATO website for instructions on setting up online services for your business

https://www.ato.gov.au/General/Online-services/Accessing-online-services-with-myGovID-and-RAM/

Some points to note:

- A myGovID is different to a myGov account

- Each individual accessing online services requires their own myGovID

- myGovID requires an app downloaded to a smart device

- Identification is required to set up a myGovID

- Relationship Authorisation Manager (RAM) is an authorisation service that allows you to link individual myGovIDs to the business

- A principal authority must link the business in RAM

More information on the principal authority can be found here https://info.authorisationmanager.gov.au/principal-authority

If you require assistance getting started with your myGovID or updating the authorised contacts please contact us.

Alternatively, we can enrol and report on your behalf, please contact us to discuss costs involved.

Cash Flow Boost Payments (PAYGW credits)

Cash flow boost payments are now being credited automatically by the ATO upon lodgement of activity statements.

The cash flow boost will be automatically calculated on the relevant activity statement once lodged and you will be advised of any remaining refund or amount payable.

Activity statements are to be lodged as normal.

Business Support Fund

A reminder that a $10,000 grant may be available under the Business Victoria Support Fund. These grants are available for small businesses that employ staff and are subject to closure or are highly impacted by the shutdown restrictions announced by the Victorian Government as a result of coronavirus (COVID-19).

Business Victoria has identified the following business sectors which will be eligible to access the grant:

- Accommodation and Food Services (e.g. cafes, restaurants, caterers, hotels, motels)

- Arts and Entertainment (e.g. cinemas, performing arts venues, creative spaces, performers, museums)

- Health and Beauty Services (e.g. hairdressers, barbers, beauty therapists)

- Sport and recreation (e.g. gyms, swimming pools, indoor climbing, play centres)

- Tourism (e.g. tourist transport, tour operators, tour arrangement)

- Retail, other than supermarket, groceries, liquor and pharmacy businesses

- Other Services (e.g. real estate agents)

Eligibility for this fund will be assessed against the industry classification of the applicant’s Australian Business Number.

Applicants should ensure that the industry classification linked to their Australian Business Number reflects their current situation.

Mandatory Code of Conduct for Commercial Leases

On 15 April 2020, the Victorian Premier announced that there will be an emergency sitting of Parliament on Thursday 23 April 2020 to pass legislation to implement the Code.

To our understanding, and if passed, the Code will be for 6 months from 29 March 2020 and is to provide a set of good faith leasing principles of the following:

- landlords cannot terminate a lease for non-payment of rent; and

- tenants must continue to comply with their obligations under the lease; and

- landlords must offer tenants reductions in rent in the form of waivers and deferrals, proportionate to the reduction in the tenant’s trade during the pandemic period; and

- rent waivers must constitute no less than 50% of the total reduction in rent; and

- any reduction in statutory charges or insurance will be passed on to the tenant, and landlords should waive recovery of expenses and outgoings where appropriate; and

- landlords must not draw on a tenant’s security for the non-payment of rent; and

- landlords agree to a freeze on rent increases.

The code will only apply to the following commercial leases, where the tenant has:

- an annual turnover of less than $50 million; and

- the tenant must be eligible for the Commonwealth Government’s JobKeeper Payment.

Land Tax Relief (Victoria)

Landlords can apply for a 25% reduction in 2020 land tax if the tenants have been impacted by COVID-19.

This relief is available for:

Residential Properties

as the landlord you must demonstrate:

- all or part of the property is available for lease; and

- that at least one of the tenant’s inability to pay their normal rent or your inability to secure a tenant is affected by the COVID-19; and

- you as the landlord has provided rent relief to the affected tenant(s).

Commercial Properties

as the landlord you must demonstrate:

- all or part of the property is available for lease; and

- that at least one of the tenant’s inability to pay their normal rent or your inability to secure a tenant is affected by the COVID-19; and

- you as the landlord has provided rent relief to the affected tenant(s); and

- the tenant has an annual turnover of up to $50 million; and

- the tenant must be eligible for the Commonwealth Government’s JobKeeper Payment.

This relief is also available to land owners who are unable to secure a tenant (residential or commercial properties) because of COVID-19.

How much rent relief do landlords need to provide?

For both residential and commercial landlords, to be eligible for the 25% land tax reduction, you need to at least pass on the equivalent amount in rent relief to your tenant.

Application for Relief

Application forms for this reduction will be published on the SRO website in the coming weeks.

Should you have any queries in relation to the above please do not hesitate to contact me directly.